Inflation in the Eurozone Drops Below ECB Target for the First Time in Three Years.

Consumer Price Growth in the Eurozone Slows Down for the First Time in Three Years

In September 2024, consumer price growth in the Eurozone slowed to 1.8% year-on-year, according to Eurostat data. This is significantly below the European Central Bank's target. A rate cut is now expected at the next meeting.

In September, consumer prices in the Eurozone decreased by 0.1% compared to the previous month. This occurred due to a slow growth in service prices, leading to a reduction in the core inflation rate from 2.8% to 2.7% year-on-year.

In September, there was also a slowdown in the growth of service prices, which increased by 4% compared to the previous year, which is also less than in August, when the growth was 4.1%. Prices of non-energy industrial goods remained at the previous level, while energy prices decreased by 6% (minus 3% in August).

ECB Interest Rate Cuts

In September, the European Central Bank cut all three interest rates. This was in line with analysts' expectations, who anticipated a cut following the slowdown in inflation in August. At the end of August, the overall inflation was 2.2%, while core inflation remained at 2.8%.

The slowdown in inflation was driven by falling energy prices. The ECB forecast assumes that consumer price growth will recover and return to the target level of 2% by the end of 2025.

Source: Forbes Ukraine

Read also

- Trump expressed confidence that the truce between Israel and Iran will last forever

- Zelensky and Starmer met with military personnel undergoing training under the Interflex program in Britain

- Trump called Iran's attack on the American base in Qatar a 'weak response'

- Medvedev made a loud statement about the nuclear arsenal for Iran

- Front line situation as of June 23. General Staff report

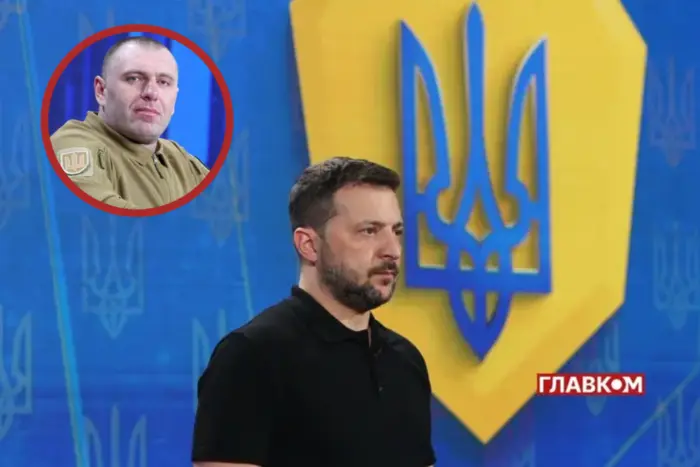

- Assassination attempt on Zelensky, suspicion against Chernyshov, Strike on Kyiv. Main events of June 23